There are different kind of not always obvious relations between the so-called “regional currency of the Internet” (Yves Mersch, member of the Executive Board of the European Central Bank) and the traditional sense of territory. A torrent of questions arisen within this subject, for example: What kind of region is the Internet? Or in what sense the regionality of Bitcoin must be understood? If and how the countries’ dispositions can influence the adoption of Bitcoin in relation to the price? Which are the different interest and reasons for accepting or rejecting it? Does this influences the adaptation of the digital currency to already existing law or the creation of new regulation to embrace it or reject it? As what kind of object is Bitcoin understood in each country? How does this modify the former questions?

As part of an ongoing research to answer some of these questions, I have been tracking statements of different countries1 regarding digital currencies (not only Bitcoin, although it is the most used example). Most reactions cluster at the end of 2013 and all have different weight regarding its legal validity. It’s important to state that this work is in a baby stage, the data is not always consistent and it lacks a rigid statistical analysis. It’s interesting to see that few countries have made formal legal measures: of 43 countries, only Brazil, China, Germany and New Zealand have adopted explicit legal responses and from these countries, only China has forbidden its use in some manner. Most states present a rather cautious approach, strongly advising precaution on the use of digital currencies but without necessarily expressing a negative opinion. This restrained reaction is tied, I think, to the incapacity to adapt the cryptocurrencies definition to one within the previous legal enclosure of fiat currencies.

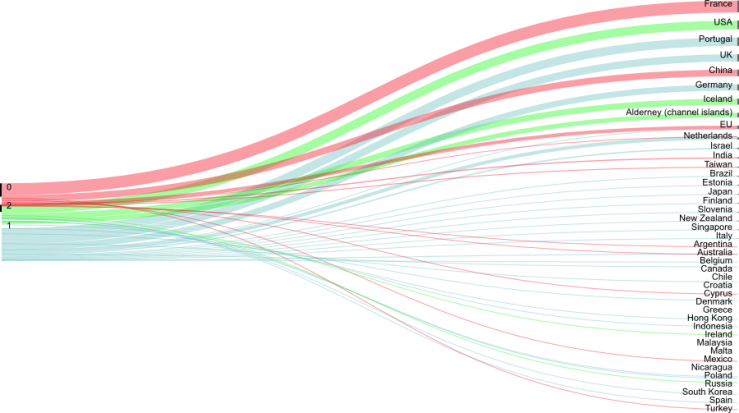

Fig. 1 presents the resolution date by country. In it, colors represent reception of alternative digital currencies, red being is a strong negative, green a strong positive and blue a neutral or mixed one. I have included only countries where a legal voice has declared a stance. For instance, a press release of the Bank of Portugal declares, based on a study of European Central Bank (Bagnall et al., 2014), that users can buy and sell virtual currency with legal tender and purchase goods and services in the real and virtual world. I take this as a neutral statement since it does not encourage nor forbidden the use of it, however, I consider it to be legislative weak since the format of the press release does not offer a legal framework to support the resolution. In the case of India, its Central Bank issued public notice cautioning users, holders and traders of the inherent risks regarding cybersecurity, legal, financial aspects; therefore I consider it a negative non-legislative resolution, i.e. a small red dot. Also, I consider positive the case of the United States as in the hearings sustained last November (with the presence of Patrick Murck of the Bitcoin Foundation and Jeremy Allaire of Circle) government representatives declared there were no concerns for misuse of the new currencies since the U.S. Government had the tools to monitor and contain any type of crime facilitated by these coins. Bigger dots in the chart indicate a legislative decree that specifically deals with digital currencies (which has only occurred in the formerly named countries).

Most resolutions are synchronous with the price bubble of the last year. The price change however, does not appear to correlate with resolution negativity (still, there is barely enough data to sustain a statement here at the moment). Fig. 2 shows the percentage change between a day before and a day after a resolution2. One can see that most resolutions cluster in the range between October and December of 2013, unsurprisingly, this is the moment when the price achieved its highest peak (1151 USD on the 4th of November). I expected a lower percentage change correlated with a strong and negative legal resolution, such as the case of China, and a higher change with a positive statement, however, the price roller-coaster of the end of 2013 does not appear to be determined by governments reactions.

Fig. 3 shows more clearly that the biggest upscale change in the price coincides with the negative response of France, followed by the positive resolution of the U.S. and the neutral effect of Portugal. Again, this apparently shows that the uprise of the price was barely related with the position of any government. Nevertheless, the attention of the media and governments on bitcoin at the end of 2013 most probably corresponds with the uprise in its price and popularity, despite if each actor had a neutral, negative or positive answer to the phenomenon.

—

1 Most of this information, so far, comes from (Global Legal Research Directorate, 2014). I expect to collect a decent amount of data point throughout the year.

2 All prices taken from (“Bitcoin Market Price (USD),”)

[…] this statements were made in the media boom and second price bubble at the end of 2013 [1]. On a previous post I coded the negative, positive and neutral legal reactions of countries on cryptocurrencies and it’s (lack of) correlations with Bitcoin’s price jump at the end of […]